Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The H4 market construction remained bearish.

- The each day chart confirmed that $1350 and $1280 might see some reduction from the promoting.

News that Voyager was liquidating its Ethereum holdings noticed the bearish stress intensify within the crypto market. On-chain evaluation confirmed they had been partly liable for the sell-off seen in March.

Is your portfolio inexperienced? Examine the Ethereum Profit Calculator

On the value charts, there was no respite but from the bearish momentum. The sellers had been totally dominant, though bulls have seen some small pleasure over the weekend. This was unlikely to reverse the downtrend.

One more imbalance on the chart, however will this one be crammed?

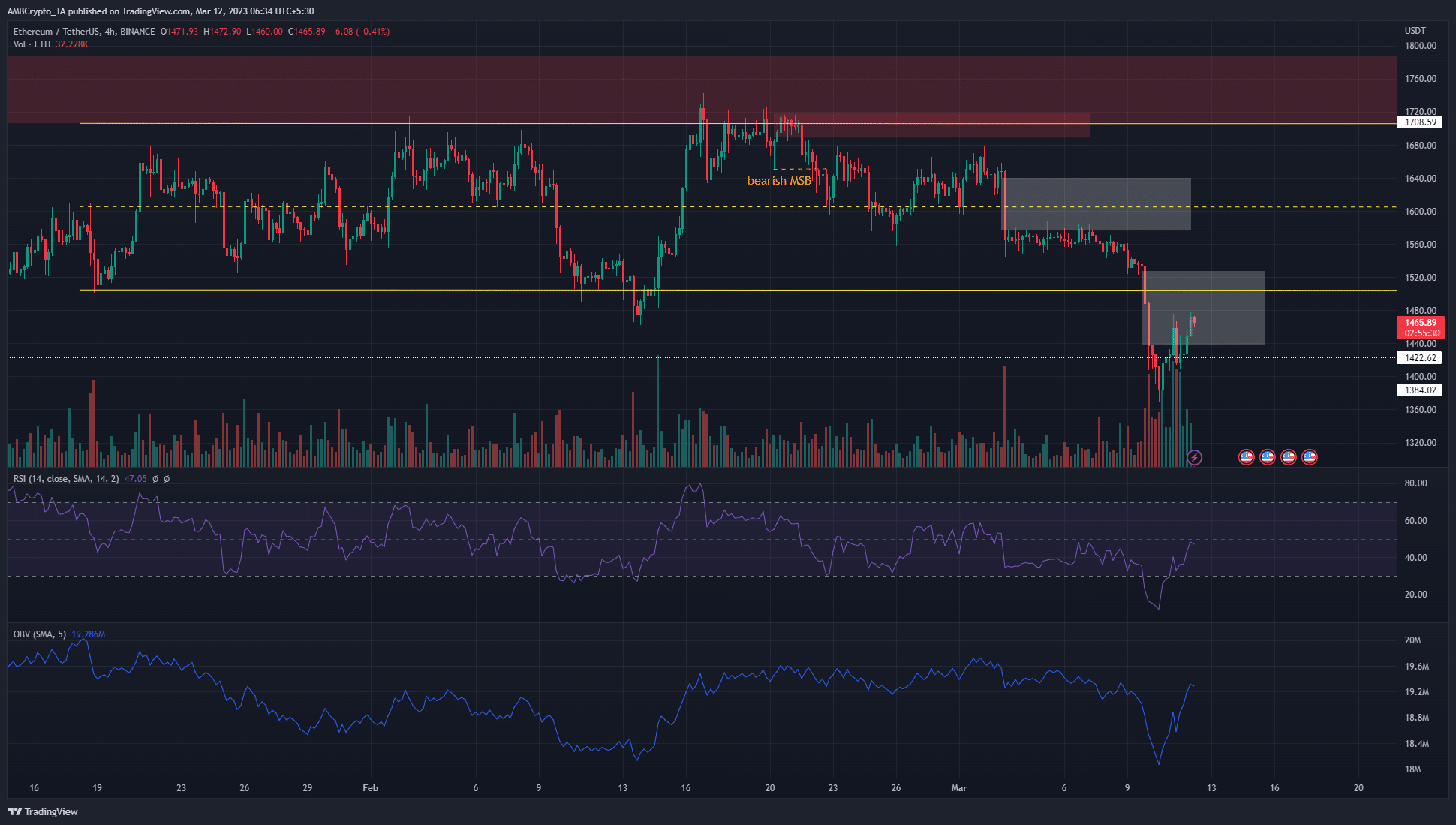

The sharp drop on 3 March left a big imbalance on the 4-hour chart, highlighted in white. Equally, one other truthful worth hole was introduced final week when Ethereum dived from $1527 to $1437, and each imbalances had been highlighted in white.

The primary one didn’t see a significant fill, however the latter hole is near seeing 50% crammed, which might be at $1482. Furthermore, the $1475-$1480 space has acted as resistance over the 24 hours previous press time.

The RSI appeared to retest the impartial 50 as resistance on the identical time the value neared a decrease timeframe resistance band. But, this might simply end in Ethereum shifting increased to $1500, as weekends are likely to see volatility with out buying and selling quantity. In the meantime, the OBV noticed a resurgence to focus on some shopping for stress.

Practical or not, right here’s Ethereum’s market cap in BTC’s phrases

The market construction remained bearish on each the 4-hour and the each day chart, and ETH is prone to sink towards new lows. $1420 might present some decrease timeframe assist. Beneath $1400, the $1280 stage might additionally see demand arrive.

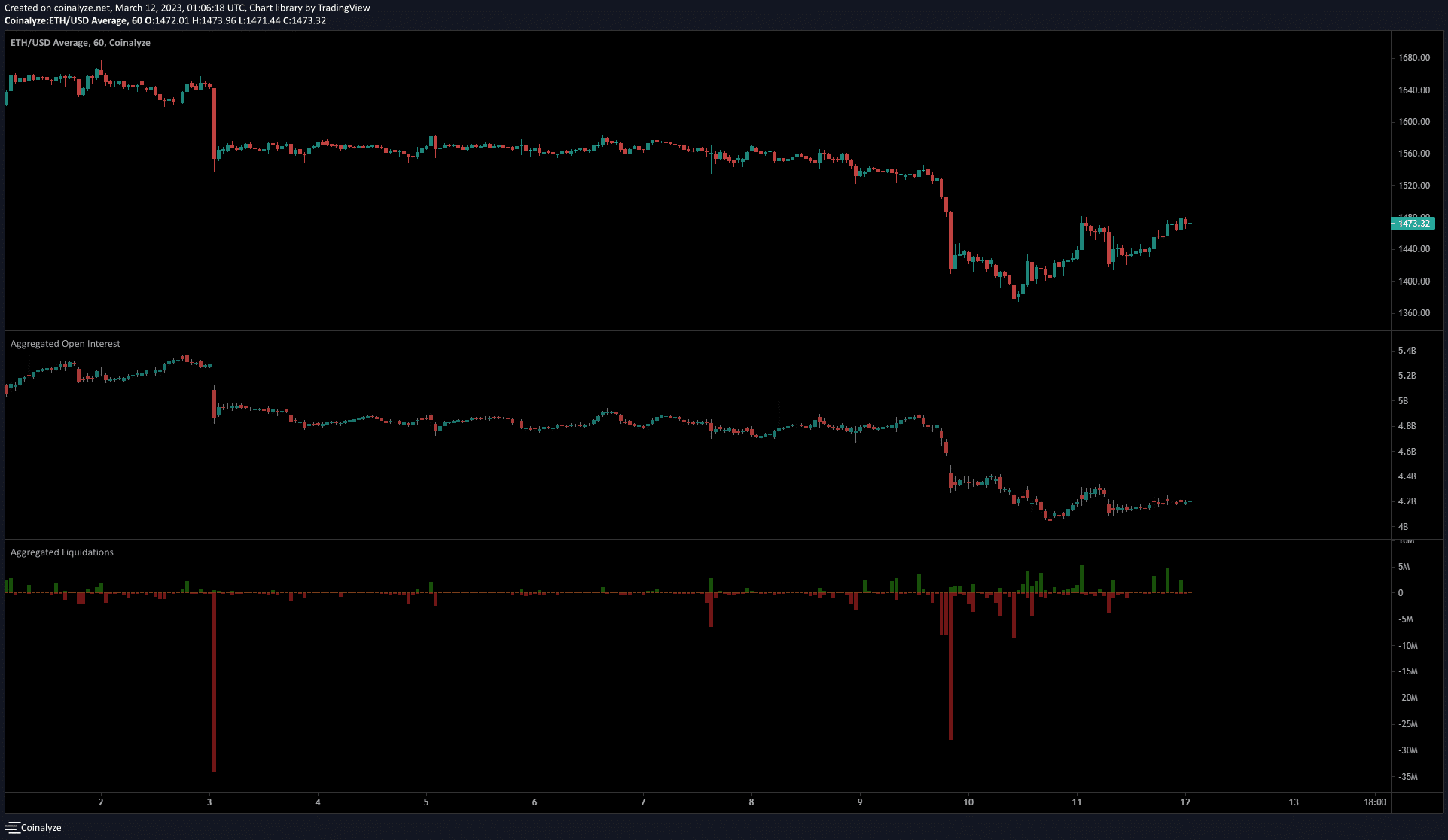

The liquidation cascade noticed $44 million longs worn out in a matter of hours

Supply: Coinalyze

On 9 March, Ethereum dropped from $1525 to $1415 throughout the house of three hours. Throughout this era, Coinalyze knowledge confirmed that $44 million value of lengthy positions had been liquidated. Later, the value fell to $1368 however has posted a bounce on the charts since then.

Though this bounce measured positive factors of 6.5%, the Open Curiosity was in decline. This confirmed robust bearish sentiment remained available in the market and was not swayed by the meager bounce.